The Q2 2023 unverified recycling figures released by the Environment Agency indicate another strong performing quarter.

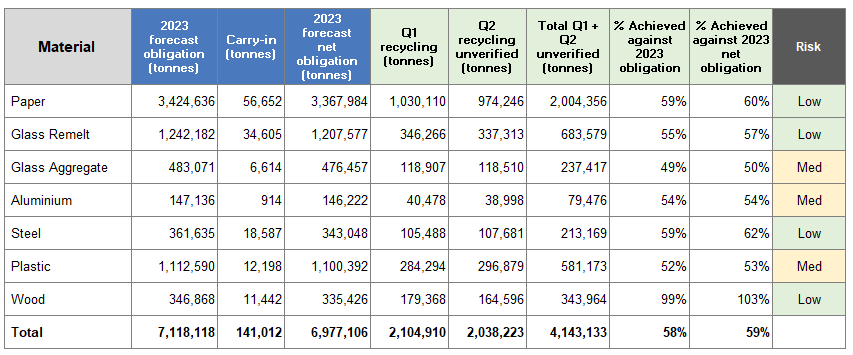

The table below shows recycling evidence requirements for 2023. It also shows the carry out tonnage reported earlier in the year from 2022. Carry out is the number of PRNs produced in December 2022 that are issued for 2023 use.

This gives us a net obligation for 2023. We can then see the Q1 verified and Q2 unverified data for 2023. Although Q2 is not another record quarter, it is still a strong performing one, and the correction in PRN pricing across many materials has not caused a massive reduction in PRN generation.

What does this mean for producers?

The unverified Q2 2023 data has benefited from the ongoing strong performance of the recycling industry, which started in Q4 2022. Looking forward, the industry now needs to continue to perform well throughout the year to produce enough PRNs in 2023. The challenge may come not from the strong performance of recycling, but the uplift in obligation from late submissions.

Medium risk

Aluminium

Aluminium has performed well in Q2, and based on these interim figures is ahead of target. However, aluminium continues to be a packaging material of choice for consumers. In response, brand owners are switching away from plastic and glass to aluminium. There is a risk that as more companies complete the registration of their obligation, the aluminium obligation will climb. This will put pressure back on demand for PRNs and indeed price.

Aluminium will remain a material of concern this year as it seems unlikely that there will be a significant, or any, reduction in UK obligation compared to 2022.

Glass

The limited availability of glass aggregate in the market is shown in the latest data. Although this is partially driven by reduced demand for the material since Q3 2022, it is also a feature of the significant export market for glass. Regulation is expected to change in 2024, however this shortage of glass aggregate is expected to continue in 2023.

Glass remelt recycling volumes in Q2 continued to remain strong, however. Glass remelt needs to perform well in order to make up for the shortfall in glass aggregate, which continues to have low availability. The challenges in glass have continued into Q3, but prices have softened in recent weeks and with lower obligation numbers we hope to see glass in balance, between obligation and PRN production.

Plastic

Plastic recycling has missed its in-year target for the last three consecutive years. The Q2 2023 interim numbers show a small improvement over Q1. The price to support that level of PRN generation has also been more muted compared to Q1. Prices have softened slightly, but any significant uplift in obligation from late submissions is likely to cause a spike in PRN prices for plastic.

Low Risk

Steel

Steel volumes in Q2 have improved as we put behind the operational challenges faced last year. Steel is a declining packaging material, and we therefore can envisage a reduction in obligation in 2023. PRN prices have continued to soften in light of the Q2 figures.

Paper

The strong Q2 interim numbers are just below the magic 1m, but are close. This remains above market sentiment and as a consequence the PRN price has reduced further from the reduction noted on publication of the previous Q1 data. Overall market trends remain unchanged however, with OCC prices falling and demand for post-consumer packaging decreasing due to an overall drop in consumer spending.

Wood

Wood has achieved its recycling target for 2023, albeit based on the current obligation numbers which we know are understated due to missing registrants. There is additional pressure on ensuring volumes remain high as wood is relied on to meet the overall general recycling target. The PRN price will track against the paper PRN prices as both materials will be used to meet general recycling.

Looking ahead

Ecosurety will continue to communicate the changes in the PRN market throughout the year. The Q2 2023 data is positive overall, with many PRN prices softening as a result. We must bear in mind that the initial obligation data shows 700+ companies are still to report their obligation, so these numbers are understated. Initial analysis shows a risk with aluminium and potentially plastic in producing enough PRNs in year.

Ecosurety members can access PRN market insights analytics in the Ecosurety Hub website to view regularly updated market performance information.

If you would like to speak with Ecosurety, please contact us on 0333 4330 370.

Nigel Ransom

Head of Procurement

As Head of Procurement Nigel and his team are responsible for buying PRNs for all Ecosurety's scheme members. He undertakes market research and data analysis and makes informed decisions for the benefit of members.

Latest News

Draft packaging EPR regulations sent to European Union and World Trade Organisation

By Louise Shellard 02 May 2024

European Parliament introduce regulations to improve packaging sustainability

By Louise Shellard 30 Apr 2024

Q1 2024 recycling data reveals good performance in most materials

By Nigel Ransom 29 Apr 2024