The Q4 verified recycling figures released by the Environment Agency indicate a reasonably performing quarter and a strong year overall for 2023.

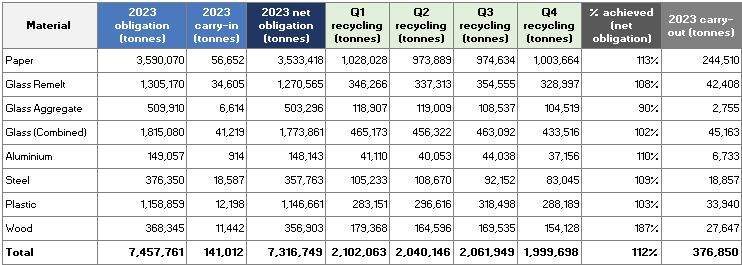

The table below shows recycling evidence requirements for 2023. It also shows the carry in tonnage reported earlier in the year from 2022. Carry in is the number of PRNs produced in December 2022 that are issued for 2023 use.

This gives us a net obligation for 2023. We can then see the Q1, Q2, Q3 and now Q4 verified data for 2023. Although Q4 is not a record quarter, it is still a reasonably performing one, giving a strong outturn to 2023 overall.

What does this mean for producers?

The Q4 2023 data has benefited from the strong performance of the recycling industry delivered in Q1-Q3, which started in Q4 2022. All materials except Glass Aggregate have produced a surplus of PRNs in 2023, in contrast to the performance in 2022. This should give the market greater stability in 2024, but at this point it's very early to make a firm prediction. However, at the end of Q1 2024 we have seen significantly improved price stability in plastic compared to 2023. Given that 2023 is completed as a compliance year, the risk categorisation is for PRNs in 2024.

Medium risk

Aluminium

Aluminium produced a record Q3, with Q4 falling back considerably from that record. This was probably caused by a major price correction in the market on the publication of the Q3 data and a lack of buying in the market. Producers responded by reducing PRN production. 2024 has seen a continuation of a low process in Aluminium PRNs, however, of more concern has been the limited appetite to sell aluminium PRNs at the current market prices. With the UK obligation figure coming out in May it will be interesting to see how the aluminium PRN price will climb. The limited availability of Aluminium PRNs is not a cause for concern at this point in the year, and it is hoped that the market will settle to a price that both sellers and buyers are content with.

Glass aggregate

The limited availability of glass aggregate meant that this was the only material to fail to meet in-year compliance in 2023. Normally glass aggregate trades at a discount to glass remelt although in part of 2023 they were trading at the same price. It is expected that 2024 there will be, once again, a shortage of glass aggregate which will need to be made up by an oversupply of glass remelt. However, in Q1 2024 availability of glass aggregate has been very good and prices have fallen. So we will need to wait for the Q1 2024 data to confirm that the availability of glass aggregate is improving.

Glass remelt

Glass recycling volumes in Q4 continued to remain steady, but down from Q3. Glass remelt needed to perform well to make up for the shortfall in glass aggregate. The challenges in glass have continued into Q1 2024, not so much in price but availability. We have seen limited availability of glass remelt PRNs in Q1, but a good supply of glass aggregate. As the year progresses we expect glass remelt availability to resume to normal levels.

Low risk

Plastic

Plastic produced a record quarter in Q3 and like aluminium Q4 fell back considerably. The publication of the Q3 data predicted that plastic would make its in-year target in 2023, with monthly data in November and December confirming this. The subsequent price drop reduced PRNs in the market until December, when PRNs can be used in both compliance year 2023 and 2024. In 2024 plastic PRNs have fallen into a nice balance of price and availability and we have seen considerably less volatility thus far. It will be interesting to observe the Q1 2024 data to see if this trend can continue.

Steel

Steel volumes in Q4 have declined again compared to Q3, giving one of the lowest quarterly performance in the last five years, however, this was not a material of concern in 2023. Steel is a declining packaging material, and we therefore can envisage a steady reduction in obligation in 2024. PRN prices have started 2024 low, on the back of 2023 and availability has been reasonable.

Paper

The strong Q4 numbers are at the “magic” one million, this is the third-best quarterly performance in the last five years. This remains above market sentiment and as a consequence the PRN price has stayed low and that trend has continued in 2024. However overall market trends remain unchanged, with OCC prices falling and demand for post-consumer packaging decreasing due to an overall drop in consumer spending. In 2024 we have the challenges of the Red Sea shipping, which particularly affects paper, which is exported to destinations in the Far-East and India. Although the price increases from shipping have not yet fed into the PRN price, this risk remains.

Wood

Wood has achieved its recycling target for 2023, Q4 data was low compared to performance in the last five years but this was not material. In 2024 the wood recycling target has increased which may cause prices to firm up, but the overall stellar performance in producing PRNs makes this a risk with low impact.

Looking ahead

Ecosurety will continue to communicate the changes in the PRN market throughout the year. The Q4 2023 data confirmed 2024 as a good year for recycling with only glass aggregate not achieving in-year compliance.

If you would like to understand more about how the recycling data impacts your PRN obligations, please contact us on 0333 4330 370.

Nigel Ransom

Head of Procurement

As Head of Procurement Nigel and his team are responsible for buying PRNs for all Ecosurety's scheme members. He undertakes market research and data analysis and makes informed decisions for the benefit of members.

Latest News

Q1 2024 recycling data reveals good performance in most materials

By Nigel Ransom 29 Apr 2024

Deposit Return Scheme for all UK nations set for 2027

By Louisa Goodfellow 26 Apr 2024

All EPR mandatory labelling pushed back to 2027

By Louisa Goodfellow 25 Apr 2024