Deposit Return Scheme

What is the Deposit Return Scheme (DRS)?

Am I affected?

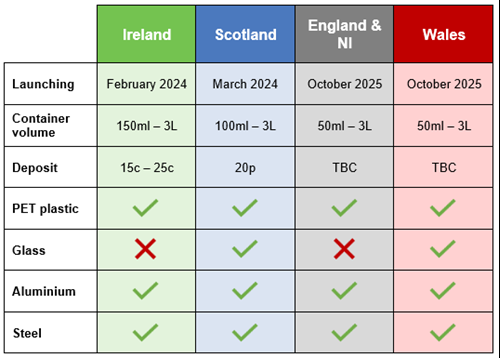

Each nation in the UK is implementing a DRS slightly differently, as summarised in this table.

It has been confirmed that England and Northern Ireland will exclude glass from their DRS, but Wales will not. Scotland is yet to confirm if glass will be included. We do not yet know how the systems will interact but there may be complications for those putting glass bottles on the market.

It is also likely that England, Wales and NI will not implement a flat deposit rate, unlike Scotland, meaning there could be further complications and risks of fraud where different deposit amounts apply to different countries.

How much will the DRS cost?

Scotland meanwhile has already confirmed a deposit cost of 20p with retailers expected to collect a target percentage of in-scope containers.

Producer fees will be set to cover costs associated with the logistical, administrative and recycling activities surrounding the scheme.

What do I need to do now?

Registration

If you are an obligated producer placing drinks containers on the market in the Republic of Ireland, you should register now. Visit re-turn.ie now to find out how.

If you're an obligated producer in Scotland, registration is now open with deadline of 12 January 2024 - however, this may change following news in June 2023 that the launch date has been pushed back to October 2025.

Registration details for England, Wales and NI are yet to be confirmed.

Product categorisation and tracing

In-scope containers will likely have to be earmarked for the deposit mechanism, for instance via their SKU codes. This will be especially important given the four devolved administrations may have different DRS structures.

Logistics

If you have a retail site that sells in-scope material, you will likely have to host consumer take back. This may involve installing a reverse vending machine or having a back of store area to keep empty containers. If you are a producer without physical retail sites, you may be obliged to collect scheme packaging from return points.

The DMO, if implemented, would be responsible for managing financial flows, including producer fees, logistics, and potentially infrastructural activities such as maintaining reverse vending machines. If this were the case, the logistical and administrative responsibilities above may be alleviated.

We are here to support you

Future services and support

We are developing further services to support our members with the future requirements of the DRS and are working with government and industry to seek further clarification on the mechanics and requirements of the system. We will continue to offer guidance as legislation is updated and we will let our members know what further support we will provide in the future.

Find out more about packaging EPR

You may also be interested in...

All EPR mandatory labelling pushed back to 2027

By Louisa Goodfellow 25 Apr 2024

Q4 2023 packaging recycling data reveals reasonable performance for most materials

By Nigel Ransom 05 Apr 2024

Packaging EPR data regulations set for new update

By Louisa Goodfellow 25 Mar 2024