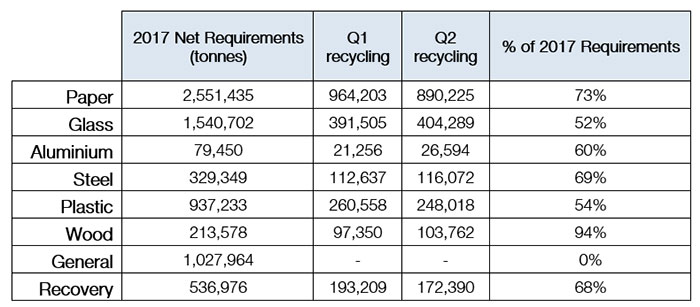

The latest figures released by the National Packaging Waste Database (NPWD) show the UK is currently on track to meet recycling obligations under the packaging regulations.

Plastic in particular has been a cause of concern all year with the price rising throughout Q1 and Q2. These figures appear to show that the high prices have driven the levels of recycling required to ensure that the UK has completed over 50% of the recycling target as we move into the second half of the year, fulfilling over 500,000 tonnes of recycling.

Will prices fall?

When figures are released stating a PRN market is on track to achieve compliance for the year, it usually alleviates pressure. This could prove to be important for the plastic PRN market which this year has been driven by speculation around the future performance of the Chinese plastic recycling market.

China lodged a motion with the WTO on Thursday which seeks to ban imports of certain types of mixed waste paper and four types of plastic waste from the beginning of 2018. Although the ban has not been finalised, this could have a major impact on the cost of compliance for producers in 2018.

In the short term, plastic prices are likely to remain volatile in Q3. Even with good figures, the China announcement is likely to continue price volatility as UK exporters plan to drive recycling elsewhere for next year. However, it could be argued that the deadline of 2018 could see plastic exporters move all remaining tonnage through China before the doors close.

Robbie Staniforth, commercial manager commented "There are a number of ready-to-market technologies that could be implemented in the coming months and years which would ease the reliance on China. We will be working closely with our partners to ensure that the work to date to improve recycling rates does not stall. Ultimately, we support the improvement of material quality whether it’s reprocessed in the UK or abroad."

2018 looks likely to be a highly stressed year in the plastic PRN market. We’ll be advising members closer to the time how to budget for this material.

As for other materials, Paper, General and Wood could see stress in 2018. If China bans all imports of waste paper then we could see a reduction in the amount of paper PRNs generated, which could have a knock-on effect with the other materials. However, this impact is likely to be small as the UK has a well-established paper recycling market.

If you would like to discuss how this news may impact your compliance costs, please contact our team on 0333 4330 370 or email info@ecosurety.com.

Richard Hodges

Key account manager

As key account manager Richard helps our largest clients manage their legal obligations under Packaging, WEEE and Batteries legislation. His background in economics helps our members manage their budgets and strategically procure evidence.

Useful links

The unverified Q2 2024 recycling figures released by the Environment Agency indicate strong recycling performance, with all materials exceeding 50% of their recycling obligation. Here's our review of 2024 H1 performance.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024