Interim recycling figures released by the Environment Agency this morning show the UK is exceeding its quarterly requirements for recycling after six months of high prices.

Overall these numbers show that UK registered producers of PRNs have produced more than they are required to meet 50% of the annual demand. This follows six months of steadily increasing and sustained high value markets for UK producers.

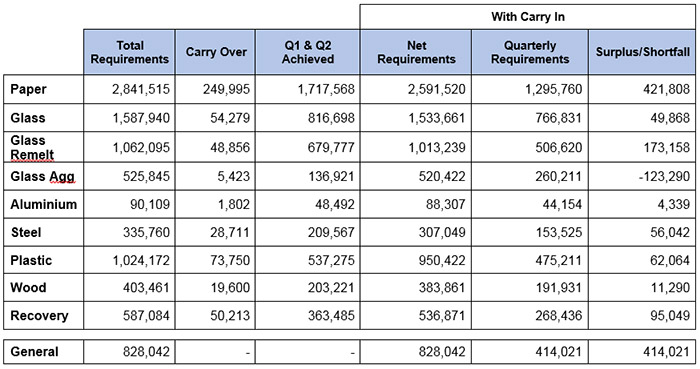

The table above shows the following from left to right:

- Total requirements – the total number of PRNs required by all UK producers in 2018

- Carry over – the total number of PRNs carried over from 2017 into 2018 (issued in December 2017 for 2018 obligations)

- Q1 and Q2 achieved – the number of PRNs generated by UK registered producers in Q1 and Q2

- Net requirements – the total number of PRNs if carry in is taken into account

- Q1 and Q2 requirements if carry in is taken into account

- Surplus/Shortfall – Q1 & Q2 production vs Q1 & Q2 demand.

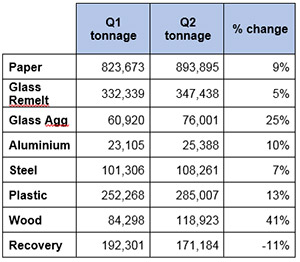

Meanwhile the table to the left shows the number of PRNs generated in Q1 and Q2 and the difference between the two quarters.

What does this mean for producers?

Plastic

Plastic has had a relatively stable year but has sustained high prices since the beginning of 2018. This high level of investment into the system should lead to an increase in the PRN production numbers and the figures today confirm this. This puts the surplus against requirements between 2% and 7%. This will help to tone down fears of non-compliance in plastic. However this may not lead to an immediate fall in prices.

Q1 had similar prices and was unable to make any surplus, so a fall in price may leave the market in a shortfall for the rest of the year. The more likely scenario is that prices should remain stable and another quarter of high prices will lead to an unassailable surplus in the Q3 figures, which may lead to a fall in the price after the Q3 recycling figures are released on 22 October.

Paper, General & Wood

These markets have had an extremely volatile quarter. Paper has risen to decade high prices off the back of Chinese recycling restrictions and the changes in wood targets have shifted the demand for general PRNs from wood and paper markets into mostly paper markets.

The figures today show a large increase in both paper and wood recycling. When considering the general recycling requirements, these figures show the markets breaking even, if carry-over figures are taken into account, however, due to the necessity of carry in figures rolling over year on year we still have a way to go to feel comfortable in these materials. If performance continues on this trajectory it may improve and this could help to dampen further price increases, but not necessarily warrant any fall in price due to the carry over needs for 2019. Expect further increases in price, but a slower rate of increase.

Glass

Glass remelt has had a great quarter and appears to be picking up the slack in glass aggregate. Glass remelt is the more expensive of the two PRNs and relying on this market to achieve compliance in glass could lead to slight increases in price. Also the issues in general could start to have an impact on the glass markets as schemes and producers seek to buy their general obligations in the lowest cost PRNs.

Aluminium & Steel

Aluminium has had a reasonable quarter, increasing its surplus against Q1. However, the level of surplus hasn’t returned to its 2017 carry in levels (around 6,500 tonnes of PRNs). This result will help to soften price increase in aluminium, but we’re not out of the woods yet.

Steel has had a strong quarter and we should have no issues for compliance. However any surplus is likely to be hoovered up for the general requirements.

Good news for producers

Overall these figures are good news for producers. If anything they should help to stem further price rises at the current rate of inflation. As they are released in Q2, we still have half of the year to go. This means there will still be ample chance for recyclers to argue they require the high prices to maintain the level of recycling and therefore for the PRN system to achieve compliance.

However, whether or not these will lead to crash reductions in prices is to be seen. We believe it’s more likely that the prices remain for another quarter and subsequent recycling figures for Q3 period provide enough of a surplus for the prices to fall post 22 October.

If you have any questions about how these figures affect your compliance costs, please contact us to speak to our team.

Richard Hodges

Key account manager

As key account manager Richard helps our largest clients manage their legal obligations under Packaging, WEEE and Batteries legislation. His background in economics helps our members manage their budgets and strategically procure evidence.

Useful links

The unverified Q2 2024 recycling figures released by the Environment Agency indicate strong recycling performance, with all materials exceeding 50% of their recycling obligation. Here's our review of 2024 H1 performance.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024