The Q4 recycling figures released by the Environment Agency indicate a high-performance quarter, albeit supported by high PRN pricing.

However, even the high prices across all materials did not deliver sufficient performance to meet the UKs 2022 obligation without relying heavily on 2021 carry out. Only wood produced sufficient PRNs within the year.

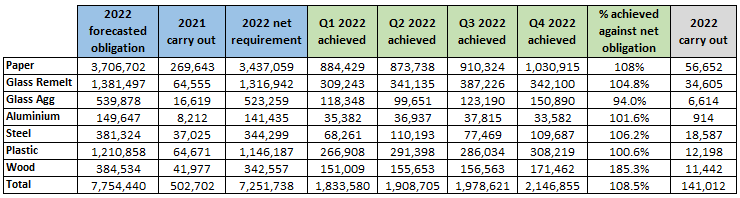

The table below shows recycling evidence requirements for 2022. It also shows the carry out tonnage reported earlier in the year from 2021. Carry out is the number of PRNs produced in December 2021 that are issued for 2022 use.

You will see from the table below that materials only met their targets due to the carry out from 2021, which is a cause for concern because carry out from 2022 into 2023 is comparatively vastly reduced.

What does this mean for producers?

Q1 2023 has benefited from the overhang of the high performance in Q4. Looking forward however, the carry out to 2023 has been decimated in many materials and the industry now needs to perform very well throughout the year to produce enough PRNs in 2023.

High Risk

Glass

Glass recycling volumes in Q4 were not as high as Q3 but were still strong. Glass remelt needed to perform well to make up for the shortfall in glass aggregate. The challenges in glass aggregate have continued into Q1 2023 with low volumes and high PRN prices.

Plastic

Plastic recycling has missed its in year target for the last three consecutive years. The 2022 Q4 figures showed that with high PRN prices the industry could produce enough PRNs in a quarter. The year end PRN prices were very high as compliance schemes needed the final PRNs in order to close the year.

Aluminium

Aluminium missed its recycling target in 2022 by almost 4%. Aluminium continues to be a packaging material of choice for consumers. In response brand owners are switching away from plastic and glass into aluminium, therefore we have seen continued pressure on aluminium PRNs into Q1 2023.

Medium Risk

Steel

Steel volumes in Q4 continued to be suppressed due to operational challenges. We have continued to see this in Q1 2023, however rising PRN prices are likely to support export which should ensure steel recycling picks up. Steel is also a declining packaging material, and we therefore can envisage a reduction in obligation in 2023, beyond that caused by the cost-of-living challenges at the end of 2022.

Paper

Paper recycling had seen good recovery in Q3 and this was continued in Q4. However, the high levels of recycling were supported by high PRN prices. Prices will need to remain high in 2023 as OCC prices fall and demand for post-consumer packaging is falling due to an overall drop in consumer spending. Assuming the paper PRN prices remain stable, the market will be reliant on the monthly data to ensure the UK is on track to meet the overall general recycling target.

Low Risk

Wood

Wood is performing very well against its recycling target. There is additional pressure on ensuring volumes remain high as wood is heavily relied on to meet the overall general recycling target. The PRN price will track against the paper PRN prices as both materials will be used to meet general recycling.

Looking ahead

Ecosurety will continue to communicate the changes in the PRN market throughout the year. Whilst the 2022 Q4 numbers are not ideal, all PRN prices will remain high to support the supply chain, this is required for stronger supply data in 2023. Only a significant reduction in obligation can bring reduce pressure on reprocesses to perform.

Ecosurety packaging members can access the interactive PRN market insights dashboard in the Ecosurety Hub website to follow the daily fluctuations in the PRN market per material and view year-to-date average market prices.

If you would like to speak with Ecosurety, please contact us on 0333 4330 370.

Nigel Ransom

Head of Procurement

As Head of Procurement Nigel and his team are responsible for buying PRNs for all Ecosurety's scheme members. He undertakes market research and data analysis and makes informed decisions for the benefit of members.

Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024