The Q2 unverified recycling figures released by the Environment Agency are disappointing across most materials, with reduced carry over from 2021.

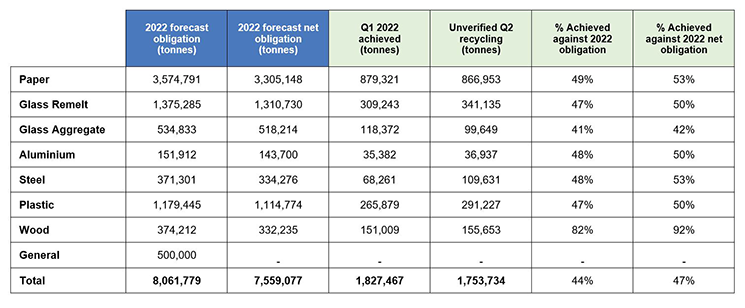

The table below shows estimated recycling evidence requirements for 2022. It also shows the carry over tonnage reported earlier in the year. Carry over is the amount of PRNs produced in December 2021 that are issued for 2022 use. The data shows that the total amount of carry over PRNs have fallen in comparison to the previous year, apart from steel.

You will see from the table below that all materials are under performing against the recycling targets.

What does the data mean for producers?

Recycling volumes across all materials except wood have not met the minimum 50% recycling target, which poses a risk to UK compliance across most materials. When the carry out volumes are factored back into the in-year supply, most materials are achieving the minimum recycling target.

There is a risk that any further slowdown to packaging waste being recovered and recycled in the second half of the compliance year will lead to significant increases to the cost of compliance for most materials. Whilst the data is unverified and we expect the volumes for some material to increase over the coming weeks, we do expect prices to increase rapidly.

Glass - high risk

Glass recycling volumes have remained low for the first half of the year, and this has mainly been impacted by the diminishing supply of glass aggregate. The glass remelt sector have suffered with significant increases in the cost of energy hence the exponential rise in costs of recycling evidence.

There are concerns within the sector that despite an increase in costs for both remelt and aggregate evidence the supply is not increasing as you would expect. Glass Remelt is likely to increase over the coming weeks and may need to cover the shortfall in the supply of aggregate.

Plastic - medium risk

Plastic recycling has seen good recovery in quarter two due to the market being supported by higher PRN prices. The export data is significantly reduced compared to last year, as exporters face export problems into Europe and the Far East and tighter EA accreditation requirements, which is resulting in exporting volumes falling.

UK reprocessing has increased which is bringing the demand and supply dynamic back into balance. PRN prices will need to continue to remain high to support the supply chain to ensure a strong supply in Q3.

Paper - medium risk

Paper recycling has had a slow start to the year and is slightly tracking behind its recycling target. OCC prices were strong at the beginning of the year but have softened as the demand for post-consumer packaging weakens.

The issues within the exports markets are causing a slowdown in evidence being issued, as the Agency are more active at the ports checking containers of waste paper destined for Europe. Excess paper PRNs are used to fulfilling the general recycling obligation so any further tightness in the paper market will pose a risk to the general recycling obligation.

Aluminium - medium risk

Recycling volumes continue to remain strong during the first half of the year, and the carry out data was also in line with the previous year. Whilst the UK demand for aluminium is due to increase as there are a handful of large producers who still need to register, there are no concerns within the market that aluminium will not meet its recycling target.

Despite the positive supply this year prices are increasing rapidly; this is mainly due to a lack of evidence available in the market.

Wood - low risk

Wood is performing very well against its recycling target. There is additional pressure on ensuring volumes remain high for the rest of the year as wood is heavily relied on to meet the overall general recycling target. Paper is tracking behind its recycling target which is why the market is seeing increases in the cost of wood PRNs.

Steel - low risk

Steel recycling is back on track to meet compliance this year. The supply issue in quarter one was mainly due to a large recycler not receiving their accreditation. Steel packaging is a material type in decline, so the market is not expecting a significant increase in demand. There is a strong carry out of PRNs from 2021 and this will help to the market on track to meet its recycling target.

Looking ahead

Ecosurety will continue to communicate the changes in the PRN market throughout the year. Whilst the half year point is not positive, all PRN prices will increase to support the supply chain, this is required for stronger supply data in quarter three.

If you would like to speak to a member of the Ecosurety team about the impact of compliance on your business, please contact us on 0333 4330 370.

Find out more about how Ecosurety works hard to make a positive impact on UK recycling.

Sandeep Attwal

Group procurement manager

Sandeep works in the role of Group procurement manager. Sandeep builds and maintains strategic relationships with our key service partners for packaging, batteries and WEEE, whilst creating new relationships and initiatives to improve UK recycling. Sandeep has over 17 years’ experience of the regulations and understands the challenges and opportunities that can arise from volatile markets.

Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024

Ecosurety sponsor the 2024 Carbon Literate Organisation Awards

By Louise Shellard 07 Jun 2024