The interim figures released today show strong recycling performance in Q2 of 2016.

This combined with the strong performance in Q1 puts the UK recycling industry in a good position to meets its 2016 targets. Plastic has performed well in particular, ending the quarter in surplus which should help further depressurise this market and potentially lower prices for producers for the remainder of 2016.

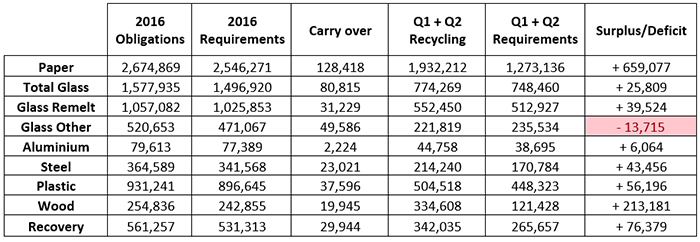

2016 packaging obligation figures

These figures represent the entire UK demand for PRNs in 2016 and the supply generated in Q1 and Q2 by accredited recyclers. The table below shows the combined recycling performance of Q1 and Q2, alongside the requirements for Q1 and Q2 according to the annual data.

You’ll see the only market in deficit in Glass Other, however with only a small shortfall, this should be rectified in the remainder of 2016. It is also important to note that Remelt PRNs can be used to cover Glass Other PRNs, and at the moment the prices are very similar for both.

Plastic figures bounce back

The quarterly figures for plastic shows the UK has a surplus of 6% in their current position. Performance in plastic recycling is highly reliant on exports. With the fall in the value of the pound since the Brexit vote, exporters have experienced a spike in trading and demand.

The pound looks likely to stay under its 23 June position for the rest of the year, and therefore UK performance should remain strong. However, India has banned imports of certain types of plastic and China will be reviewing its domestic recycling policies in November.

An incomplete picture?

A lot of recyclers are still to report, including 26 large recyclers with 20 of these registered as exporters. A large reprocessor is accredited to issue 400 tonnes or more per year. If we take an estimate of 100 tonnes per quarter, this could leave another 2,600 tonnes or more yet to be reported.

The lowering PRN prices could be having major effects on domestic recycling in the UK. Although the figures show UK and export recycling increasing at an equal rate, speculation has been that some UK producers of PRNs may have to temporarily or permanently close their doors as they battle against the fall in the oil and PRN price.

This morning, news was released that PlasRecycle have gone into administration. This plastic recycler had a 20,000 tonne capacity and its loss will have an impact going forward on the overall supply of PRNs to UK producers.

Examples like this illustrate why ecosurety believes the UK needs to value and support domestic (UK) based recycling, as it provides stability into the future for producers with plastic obligations. If we enter a situation where all PRNs are generated by exports markets, we leave ourselves open to far greater volatility going forward.

What does it mean for members?

Producers, compliance schemes and recyclers have had a turbulent start to 2016 with prices starting at a unstable and high point. A series of good results and the low pound helping exports seems to be supporting the industry as we move into the second half of 2016.

These figures also provide hope that we will move into the end of the year in a strong and stable market. This should allow an easier commercial environment to budget for the 2017 compliance year.

To discuss how the figures affect your compliance obligations, simply call our team of specialists on 0845 094 2228 or email info@ecosurety.com.

Richard Hodges

Key account manager

As key account manager Richard helps our largest clients manage their legal obligations under Packaging, WEEE and Batteries legislation. His background in economics helps our members manage their budgets and strategically procure evidence.

Useful links

The unverified Q2 2024 recycling figures released by the Environment Agency indicate strong recycling performance, with all materials exceeding 50% of their recycling obligation. Here's our review of 2024 H1 performance.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024