All materials are performing well against the recycling targets, showing a surplus in all materials.

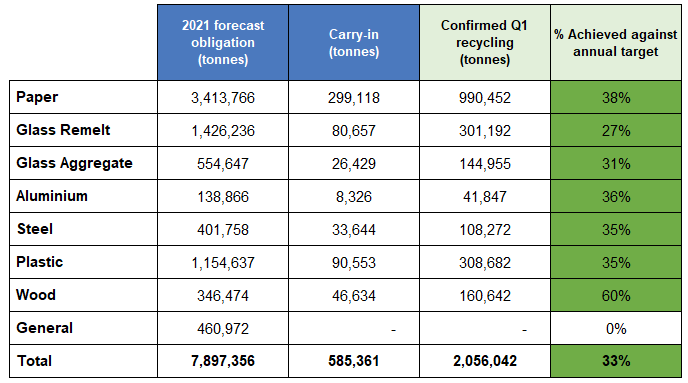

Figures released by the Environment Agency reveal the positive packaging recycling performance in Q1 of 2021. The table below shows estimated gross and net requirements for 2021.

It also shows the carry over tonnage reported earlier in the month. Carry over is the amount of PRNs produced in December 2020 that are issued for 2021 use. The data shows that the total amount of carry over PRNs has increased in comparison to the previous year, most significantly in plastic.

You will see from the table below that all materials are performing well against the recycling targets, showing a surplus in all materials.

What does the data mean for producers?

Recycling volumes have remained stable in all materials bar plastic and glass. Plastic recycling was impacted by Brexit and had a slow start to the year which saw prices peak and then soften as exporters navigated through Brexit export paperwork. Glass recycling has mainly been impacted by the increase in the forecasted demand and as we progress through the year and the further behind we get from the recycling target, the steeper the increase in PRN prices. Here we take a look at each material:

Glass - high risk

Glass has performed well against the recycling target but was heavily reliant on the carry in of PRNs to meet the Q1 glass remelt target. The published 2021 demand shows there has been a significant increase in glass packaging placed on the market in 2020 which has resulted in an increase in demand.

The glass aggregate target is also performing well, however due to the change in the remelt Vs aggregate target, less aggregate PRNs will be needed to meet compliance. There are concerns that the glass remelt PRN could see a sharp increase in prices as we continue through the year.

Plastic - high risk

Plastic has performed extremely well against its recycling target despite a slow start to the year. The recycling volumes remained low in January and February as exporters remained nervous exporting material under new Basel and Brexit rules. The demand for plastic has fallen which has created a surplus of evidence in Q1. Plastic will remain volatile for the rest of the year however, as exporters establish other end European export markets.

Paper - low risk

Paper recycling has remained solid during the first quarter of the year, combined with the increase in the carry in tonnages has meant the price of PRNs has softened over the last few weeks. There is a slight risk that should prices remain extremely low that some accredited companies may choose not to issue the PRN for such little return. There is very little risk that paper recycling will slow down over the coming months.

Aluminium - low risk

Recycling volumes continue to remain strong during the first quarter of the year, and demand has increased in line with expectations. Aluminium has already achieved 36% of its target by the end of Q1 and if it continues to perform at the levels we have seen in Q1, Aluminium recycling is forecasted to meet its target by the end of Q3. There is no immediate risk of recycling slowing down.

Steel - low risk

There are no immediate concerns with this material, however steel relies on the export market to meet recycling targets and the impact of export tariffs could see supply affected in the short term. Overall steel has performed well in the first three months of the year.

Wood - low risk

Wood is well on its way to meeting its recycling target, having achieved 60% already. The UK requires wood recyclers to continue to produce PRNs to support the general recycling target. Wood PRN prices will also continue to fall over the coming months due to the change in the recycling target from 48% to 35%.

Looking ahead

Ecosurety will continue to communicate the changes in the PRN market throughout the year. As supply is looking strong for Q1 of 2021, there is a risk that glass remelt could see a further increase in price if supply does not increase over the coming months. The good news is that as the hospitality sector comes out of lockdown glass recycling will increase.

Ecosurety packaging members can access the PRN market tracker that provides a daily update on market pricing trends and performance by clicking here.

If you would like to speak to a member of the Ecosurety team about the impact of compliance on your business, please contact us on 0333 4330 370.

Find out more about how Ecosurety works hard to make a positive impact on UK recycling.

Sandeep Attwal

Group procurement manager

Sandeep works in the role of Group procurement manager. Sandeep builds and maintains strategic relationships with our key service partners for packaging, batteries and WEEE, whilst creating new relationships and initiatives to improve UK recycling. Sandeep has over 17 years’ experience of the regulations and understands the challenges and opportunities that can arise from volatile markets.

Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024

Ecosurety sponsor the 2024 Carbon Literate Organisation Awards

By Louise Shellard 07 Jun 2024