The Environment Agency has released its Q3 recycling figures this month. They have come in lower than expected for this quarter in the year which will lead to concerns over higher prices than normal for Q4. Here's a number of reasons why.

Before considering the impact of this I’m going to look at the likely reasons why the figures are lower than expected. Firstly let's consider the figures in the table below:

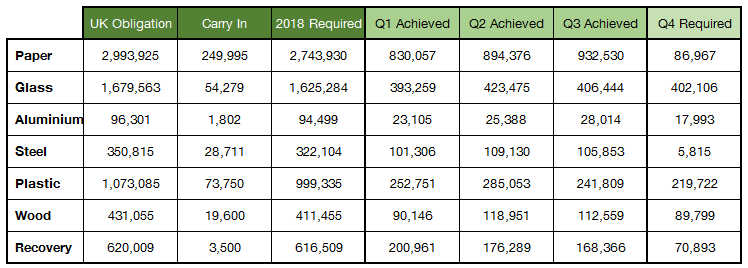

2018 Q3 packaging recycling figures

Within the final column 'Q4 required', we can see the number of PRN’s the UK needs to produce in order to meet compliance obligations for the full year. Broadly speaking, these figures show the UK is on track to meet its compliance targets. However there is likely to be a smaller carry in for key materials such as plastic, glass and wood for 2019 than there was in 2018.

General recycling target to consider

The UK also has a General Recycling target, which can be covered by any material-specific PRN. The 2018 Obligation for General Recycling is currently 875,090 tonnes.

If the final Q4 figures at the end of the year are in line with the average tonnage of the previous three quarters, much of the surplus will be taken up by the General obligations. Traditionally this is covered by the Paper and Wood markets, which has traditionally kept the price of General low.

However as the General obligation is higher than the surplus available in Paper and Wood, it means other materials have been used to cover General obligations. This will likely keep prices high and would also reduce any carry-in of surplus 2018 PRNs that would ordinarily help to bolster 2019 performance.

What do the Q3 figures mean for producers?

Plastic

Plastic has been one of the surprises of the Q3 figures. The good news is that UK capacity has been slowly climbing off the back of high PRN prices, however this is somewhat marred by a drop in plastic exports which has fallen by approximately 50,000 tonnes.

A likely contributor to the lower plastic exports figure is increased scrutiny from the Environment Agency on plastic exports as it clamps down on reported fraud in the system. This action is essential to an improved, honest and accountable recycling system, but the short term impact will be higher than average prices for the corresponding quarter.

Paper, steel & glass

All of these markets have had good quarters, with high prices leading to an increase of approximately 100,000 tonnes between Q1 and Q3.

What we need to bear in mind is that while all three materials will meet their recycling targets, any surplus will be used to cover General Recycling obligations. This has caused price rises in paper, steel and glass.

Aluminium

Although aluminium is oversupplied, the prices have continued to rise. This is due to market manipulation on the supply side. The Advisory committee on packaging (ACP) have asked the Competition and markets authority (CMA) to scrutinise this market based on concerns that prices are being artificially inflated by suppliers, with no environmental benefit.

Wood

Wood is still struggling to hit the recycling target, despite the price being 15 times higher now than at its lowest point. As such prices are likely to remain high for customers in Q4.

Though this comes as no surprise, we are aware that the stretching targets (causing high prices) are failing to attract the amount of tonnage required. In this category, we would urge DEFRA to reassess the annual targets, bringing them in line with a realistic goal that can be increased in line with industry recycling capacity year-on-year.

In summary

Overall the Q3 results show that we are likely to meet the UK targets for 2018. However the end of the year is tighter than expected and could impact the amount of carry in for 2019. High PRN prices in paper and plastics are not – as yet - stimulating UK recycling as they should be. An increase in 10,000 tonnes of capacity in the UK’s plastic recycling sector is commendable, but sadly offset by a drop of 50,000 tonnes in plastic export markets.

Producers will rightly be frustrated with these developments. Ecosurety believe that PRN money spent strategically can make a tangible difference to high PRN prices. Our current #LeedsByExample campaign is making great efforts to not only collect additional packaging waste on-the-go, but to provide a blueprint for other cities to significantly improve their capture of key materials such as plastic and cans. Our new collaboration with Recycling Technologies will also increase UK recycling capacity by 50,000 tonnes over the next three years.

Though prices look likely to remain higher than expected for Q4, Ecosurety remain committed to sourcing PRNs for our members from credible reprocessors. Through investment in innovation, infrastructure and awareness campaigns we are helping to provide sustainable solutions for our customers and the wider recycling sector.

Find out more about how we are working hard to make a positive impact on the recycling industry.

Richard Hodges

Key account manager

As key account manager Richard helps our largest clients manage their legal obligations under Packaging, WEEE and Batteries legislation. His background in economics helps our members manage their budgets and strategically procure evidence.

Useful links

The unverified Q2 2024 recycling figures released by the Environment Agency indicate strong recycling performance, with all materials exceeding 50% of their recycling obligation. Here's our review of 2024 H1 performance.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Being Carbon Literate empowers you and your organisation to make better decisions to reduce carbon impacts and communicate to stakeholders about carbon more confidently. Our course is accredited by the Carbon Literacy Project and has a specific focus on the impacts of packaging.

Read More >>Latest News

Q2 2024 recycling data shows strong performance in H1

By Sam Marshall 24 Jul 2024

Ecosurety continue to step up for refill and reuse

By Victoria Baker 24 Jun 2024

Ecosurety renews B Corp™ certification with flying colours

By Louise Shellard 11 Jun 2024